The Current State of Card and Mobile Payments

Card and mobile payments are becoming the norm. The move away from cash has accelerated with technological advancements and consumer demand.

These payment methods offer unparalleled convenience and quick transactions resulting in an increase in consumers opting for digital payments over traditional methods.

Contactless Payments: Convenience at Your Fingertips

Contactless payments are easy to use and fast. Tapping a card or device is far quicker than traditional payments.

The technology behind contactless payments is reliable and secure with consumers appreciating the combination of speed and safety.

Online Payment Gateways: The Backbone of E-commerce

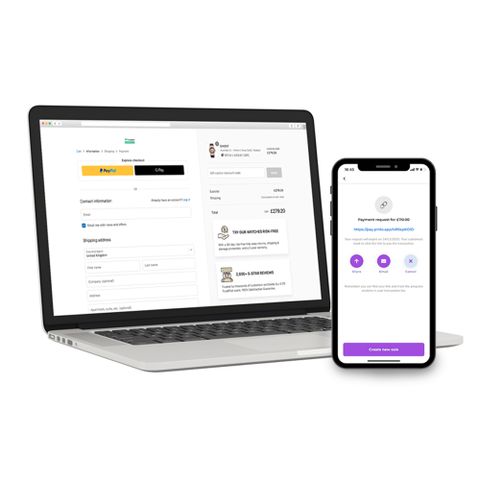

Online payment gateways are crucial for digital transactions. They ensure secure and efficient processing for e-commerce platforms.

These gateways support various payment methods, meeting diverse consumer needs, providing a seamless experience for online shoppers.

Mobile Payment Apps: A Wallet in Your Phone

Mobile payment apps are transforming smartphones into digital wallets. They allow users to make payments with just a few taps.

These apps often integrate with other services and enhance convenience by offering features beyond basic transactions.

Innovations Shaping the Future

The payment landscape is rapidly changing with technological innovations, with emerging technologies promising a faster, more secure payment experience.

Innovations like NFC technology and biometric authentication are at the forefront. These advancements are reshaping how transactions are conducted daily.

NFC Technology and the Rise of Tap-to-Pay

NFC technology is powering the growth of contactless payments, consumers can now enjoy swift transactions by simply tapping their cards or phones.

This technology enhances user experience by reducing transaction time with retailers benefiting from quicker checkouts, improving overall customer satisfaction.

Biometric Authentication: Security Meets Convenience

Biometric authentication adds a new layer of security. It uses unique physical traits like fingerprints and facial recognition to authorise payments.

This method ensures transactions are both secure and convenient with consumers appreciating the reduced reliance on passwords and PINs.

The Role of AI and Machine Learning in Payment Processing

AI and machine learning are transforming payment processing. These technologies enhance fraud detection and optimise customer service.

They enable real-time analysis of transactions whilst boosting security. AI also customises payment experiences, offering personalised solutions to users.

Consumer Behaviour and Expectations

Consumers today expect swift and seamless payment experiences and the preference for quick transactions is becoming a dominant trend.

This demand drives businesses to innovate continuously and offering a frictionless experience is becoming essential for customer satisfaction.

The Demand for Speed and Seamless Transactions

Consumers value speed in every aspect of transactions, meaning quick checkouts are crucial both online and in stores.

Seamless transactions without glitches enhance customer experience and businesses adopting these technologies are gaining a competitive edge.

Payment Data Analytics: Understanding the Customer

Payment data analytics helps businesses understand consumer habits. Analysing transaction patterns can help reveal valuable insights.

These insights enable personalised offerings and improved services. Understanding customers better, leads to enhanced experiences and loyalty.

Regulatory and Security Considerations

As payment technology evolves, security remains paramount. Businesses must address both security and compliance challenges.

Robust security measures protect consumer data whilst the regulations evolve to match technological advancements.

Payment Security: Encryption, Tokenisation, and Compliance

Encryption and tokenisation are essential for securing transactions as they safeguard sensitive data against breaches.

Compliance with regulatory standards helps build consumer trust and adapting to these requirements could be crucial for businesses.

Navigating Payment Regulations and Standards

Payment regulations help ensure fair practices and protect consumers. These regulations are continuously updated to reflect technological advancements.

Understanding these standards is vital for global operations. Businesses must stay informed to remain compliant and competitive.

The Global Perspective

The global landscape of payments is changing rapidly with technological advancements and regulatory shifts playing significant roles in these changes.

Adapting to these changes enables businesses to participate in the digital economy but caution is advised as understanding regional differences could be the key to succeed.

Cross-Border Payments and Financial Inclusion

Cross-border transactions are becoming faster and more efficient as Fintech innovations lead this evolution.

These advancements support financial inclusion, offering new services in underserved regions. This change is crucial for reducing the global financial divide.

Cryptocurrency Payments and Blockchain Technology

Cryptocurrencies are emerging as alternative payment methods but caution is advised as these methods can offer great opportunities, they also come with challenges alike.

Blockchain technology, the foundation of cryptocurrencies, promises secure and transparent transactions. However, regulatory and adoption hurdles remain significant.

Conclusion: Embracing the Future of Payments

The future of card and mobile payments is full of potential. As technology advances, the payment landscape will transform significantly. Embracing these changes is essential for staying competitive in the digital age.

Consumers and businesses alike must adapt to evolving payment methods. By integrating cutting-edge solutions, they can enhance convenience and security. Emphasising user-friendly experiences will help drive widespread acceptance and innovation in financial transactions. The future is cashless, and it promises to be seamless and efficient.