Online payments for small businesses

Empower your business with seamless transactions

Empower your business with seamless transactions

Fast Next Day Settlement1

Simple pricing with no hidden fees

Quick & easy setup

In today’s world, customers expect quick, easy, and secure2 ways to pay. Clear Business offers simple online payment solutions tailored to your needs, helping your customers pay faster, and your business run smoother.

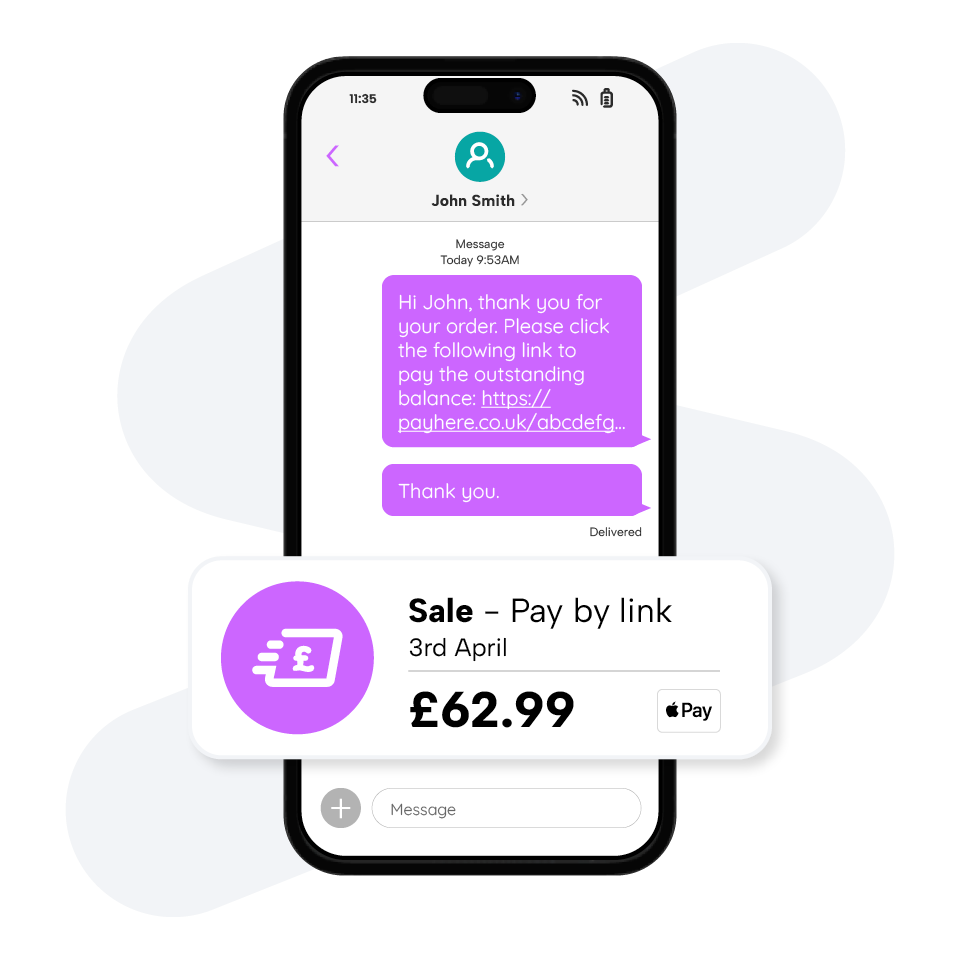

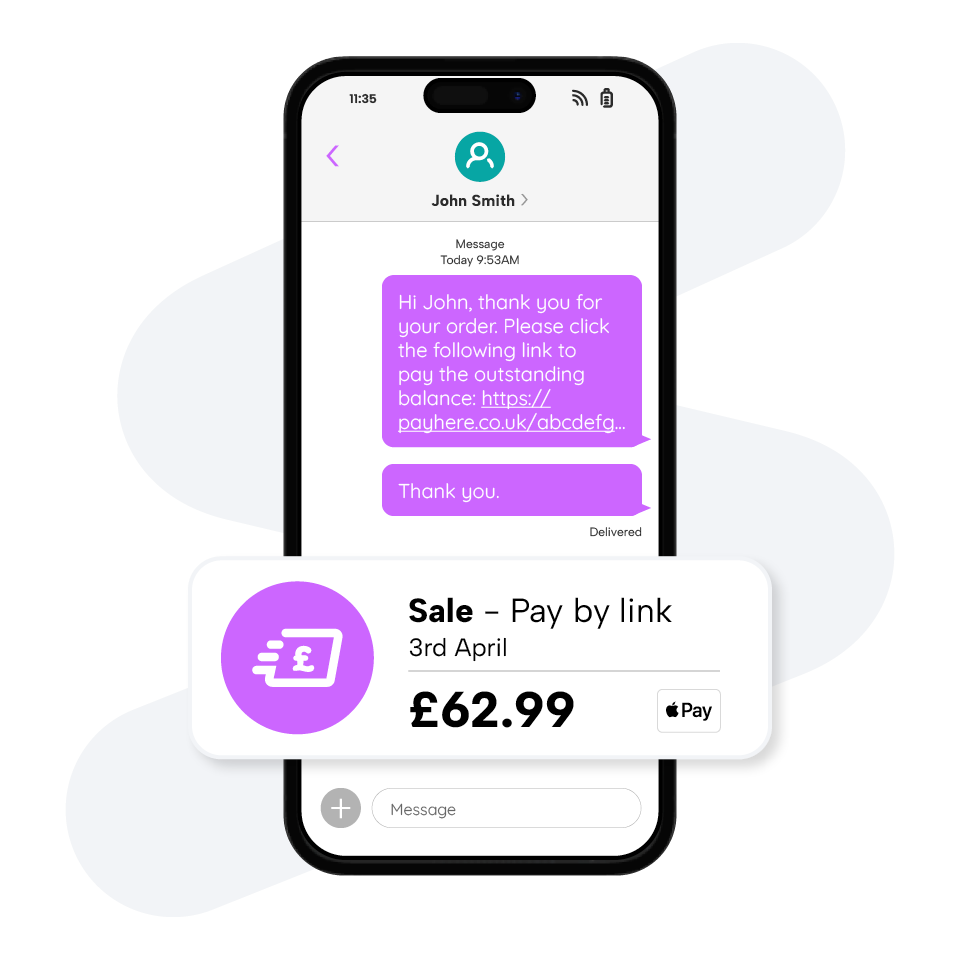

Easily send customers a payment link via email, SMS, or social media. Perfect for any business needing quick, secure, and simple remote payments with no website required2.

Integrate quick and easy payment processing into your website, giving customers a trusted and seamless checkout experience. Perfect for online shops and subscription services.

Process card payments securely2 from any device with an internet connection. Great for businesses like hotels or professional services handling bookings and orders by phone.

Over 9,000 businesses in the UK use Clear Business to take payments3

£1.2 billion in annual transaction volume3.

Partner with the UK's best performing payment gateway provider3

Tired of waiting up to five days for card transactions to reach your bank account? With Faster Payments, get the funds released by the next business day1.

Our card payment solutions are designed for simplicity. Our expert team helps you find the right system at the right price—whether you need a portable card reader or a fixed countertop machine. Plus, we’ll credit you up to £1,000 if your current provider charges an exit fee4.

It’s the customer experience your business deserves. It’s Clear Business.

Our specialist onboarding team provides dedicated support for your first 30 days or longer if needed, ensuring a smooth start.

From setup to troubleshooting, we’re here every step of the way. Don't worry after that, you’ll still have access to 24/7 support.

Sign up for one of our eligible broadband packages and get a free payment service at zero monthly cost.

The latest smart Android powered card machine

Ultrafast & reliable speeds up to 900Mbps available 6

No monthly rental for your card machine

Save over £350 across your payments contract7

Make taking payments easier while keeping more money in your pocket. This offer helps your business run smoothly without extra costs!

Get paid wherever you ‘do’ business. We understand that every business is different. That’s why we offer a range of card payment services to ensure you get the one that’s right for yours.

Enjoy straightforward pricing with our card payment services. Transparent transaction fees, no hidden costs, just simple and fair payments.

Get paid faster! Receive your funds in your bank account by the next working day, ensuring smooth cash flow for your business.1

Switch with confidence—if you face termination fees from your current provider, we’ll credit you up to £1,000 to cover the cost.4

Our leading Android-powered devices are simple to use, packed with advanced features, and designed for seamless, secure payments.

As well as modern payment solutions, all Clear Business Card Payments customers enjoy a range of additional benefits.

Secure card processing powered by the UK's #1 Payment gateway3

Rated Great on Trustpilot for our exceptional customer service.

Get tailored guidance to find the perfect card payment solution for your business.

Our dedicated onboarding team is with you 7 days a week for the first 30 days, ensuring a seamless setup and smooth operation to get you up and running with confidence.

Get your funds fast. Cash is deposited into your bank account the next working day, helping you keep your business running smoothly. No waiting, no delays, just quick and reliable access to your money.1

Access funds up to £1 million8, with repayments that adjust based on daily sales, ensuring flexibility during slower periods.9

Find out more

Access funding up to £1,000,0008 to grow your business and pay back when you make money9. Simple.

You receive a lump sum payment, which you pay back as a small percentage of your daily card sales—typically between 5% and 30%.

Unlike a traditional bank loan, you don’t need to offer any assets as security. Instead, approval is based on your average card payment earnings, using your latest merchant statements.

This funding helps you grow your business and repay only when you make sales, giving you more flexibility and control over your finances.

We offer a range of secure business card payment services from countertop and portable devices to secure online payment systems, giving you the flexibility to take payments where ever your business takes you.

A range of Smart Terminals, Mobile, Countertop & Portable Machines to suit your business needs

Whether you accept online payments through your website or send payment links to customers, we have the solution for you

Upgrade your business with our cutting-edge POS systems, designed for seamless, secure, and efficient card payments.

Stay ahead with the latest card payment trends, insights, and expert advice.

Stay informed with the latest UK business trends, finance, and industry updates to help your business grow.

Get practical tips, guides, and expert advice to grow and streamline your business.

Your services simplified.

Let’s be clear.

Use our product assistant to tailor our products to your business needs.

In today’s world, customers expect quick, easy, and secure2 ways to pay. Clear Business offers simple online payment solutions tailored to your needs, helping your customers pay faster, and your business run smoother.

Our online payment solutions help you take payments remotely, on your website, over the phone, or even using a smartphone, all with secure processing and clear pricing.

Easily send customers a payment link via email, SMS, or social media. Perfect for any business needing quick, secure, and simple remote payments with no website required.

Integrate secure payment processing into your website, giving customers an easy and trusted checkout experience. Perfect for online shops and subscription services.

Process card payments securely from any device with an internet connection. Great for businesses like hotels or professional services handling bookings and orders by phone.

Tired of waiting up to five days for card transactions to reach your bank account? With Faster Payments, get the funds released by the next business day.1

Our card payment solutions are designed for simplicity. Our expert team helps you find the right system at the right price—whether you need a portable card reader or a fixed countertop machine. Plus, we’ll credit you up to £1,000 if your current provider charges an exit fee4.

It’s the customer experience your business deserves. It’s Clear Business.

Our specialist onboarding team provides dedicated support for your first 30 days or longer if needed, ensuring a smooth start. From setup to troubleshooting, we’re here every step of the way. Don't worry after that, you’ll still have access to our expert support team, available 7 days a week.

Get paid wherever you ‘do’ business. We understand that every business is different. That’s why we offer a range of card payment services to ensure you get the one that’s right for yours.

Enjoy straightforward pricing with our card payment services. Transparent transaction fees, no hidden costs, just simple and fair payments.

Get paid faster! Receive your funds in your bank account by the next working day, ensuring smooth cash flow for your business.1

Switch with confidence—if you face termination fees from your current provider, we’ll credit you up to £1,000 to cover the cost.4

Our leading Android-powered devices are simple to use, packed with advanced features, and designed for seamless, secure payments.

As well as modern payment solutions, all Clear Business Card Payments customers enjoy a range of additional benefits.

Access funding up to £1,000,0008 to grow your business and pay back when you make money9. Simple.

You receive a lump sum payment, which you pay back as a small percentage of your daily card sales—typically between 5% and 30%.

Unlike a traditional bank loan, you don’t need to offer any assets as security. Instead, approval is based on your average card payment earnings, using your latest merchant statements.

This funding helps you grow your business and repay only when you make sales, giving you more flexibility and control over your finances.

We offer a range of secure business card payment services from countertop and portable devices to secure online payment systems, giving you the flexibility to take payments where ever your business takes you.

Stay ahead with the latest card payment trends, insights, and expert advice.

Stay informed with the latest UK business trends, finance, and industry updates to help your business grow.

Get practical tips, guides, and expert advice to grow and streamline your business.

Your services simplified.

Let’s be clear.

Use our product assistant to tailor our products to your business needs.