Top features to look for in card machines

Read more to find out how to choose the right card machine for your business. Get tips on speed, security, and compatibility to find the perfect fit for your needs.

Read more to find out how to choose the right card machine for your business. Get tips on speed, security, and compatibility to find the perfect fit for your needs.

Perfect for: Pop-up shops, salons, market stalls, tradespeople, or anyone who moves around.

Portable card machines let you move freely and serve customers wherever you are. With contactless card readers or wireless card readers, you can accept payments on the spot, no till required.

Speed things up with machines that accept contactless payments. Customers can pay with debit and credit card, digital wallets, or Apple Pay and Google Pay. It’s fast, secure, and what people expect.

You’re handling sensitive data. Choose a machine with payment security features like chip and pin, encryption, and fraud protection. Your customers’ trust depends on your payment card security.

You’ve got enough to think about without worrying if your card machine will make it through the day. Pick a portable card terminal with a strong battery. This way, you can keep taking payments without stopping to recharge.

Choose a portable card machine that links up with your mobile or tablet. Wi-Fi down? Out in the field? No problem.

Dual connectivity with Wi-Fi and 4G keeps you online. You can take payments no matter where your business goes. That’s reliable connectivity built for busy traders. It means more card transactions completed, fewer disruptions, and better service.

Perfect for: Cafés, shops, salons, and businesses with a fixed location.

A good countertop terminal or POS terminal keeps things fast and hassle-free. When transactions are quick and easy, queues stay short and customers stay happy. A quick, responsive card payment machine reduces queues and keeps customers happy. Fewer delays mean more transactions processed, fast and frustration-free.

A great payment processor should integrate with your existing POS and accounting tools. That means smoother business operations and fewer system clashes. Make sure your business card terminal plays nice with your till, accounting software, and other tools. Easy integration saves you time and effort.

Your countertop terminal should do more than take payments. Our Smart Max terminal is powered by Android 13 OS. You can run EPOS apps, manage orders, track sales, and customise workflows, all from one sleek device. The design features a fast, intuitive interface that enables quick checkouts and smooth service, even during your busiest hours.

Choose a card machine that meets the latest standards—chip and pin, EMV, encryption. Solid payment security should be built in, not an extra. Look for credit card payments and payment cards security with encryption and anti-fraud features. Keeping your merchant account safe keeps your customers coming back.

Modern countertop machines should support many payment options. These include credit and debit cards, digital wallets, and mobile devices. They should also work with Apple Pay, Google Pay, and more. You should be ready to take on whatever your customers hand over.

Look at the transaction fees. Are you getting value from the monthly fee? Sometimes cheaper means fewer features. Make sure the balance is right for your business.

Perfect for: Delivery drivers, tradespeople, remote events, and businesses on the move..

Mobile GPRS card terminals use a SIM card to stay connected through mobile networks. So you can take payments wherever you go, even without broadband. Using 4G networks, mobile card readers with GPRS let you process payments even when Wi-Fi isn’t available. This kind of reliable connectivity means you’ll never miss a sale.

Mobile card machines are built for mobility. Take payments at your customer’s door, at festivals, or wherever business happens.

Like any good machine, GPRS terminals support contactless payments, chip and pin, and digital wallets.

You can choose a portable card machine, a countertop terminal, or a mobile GPRS terminal. The goal is the same: to take payments quickly, securely, and easily.

At Clear Business, we make payments easy—so you can focus on running your business.

No matter your setup, we’ve got a card machine that fits your business. Whether it's a portable card machine, a smart countertop terminal, or a POS system, you'll be accepting cards in no time.

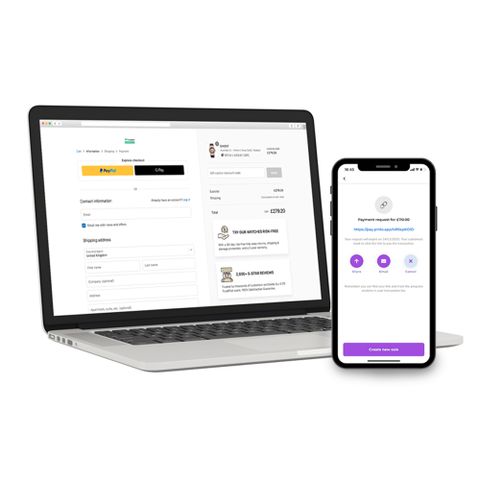

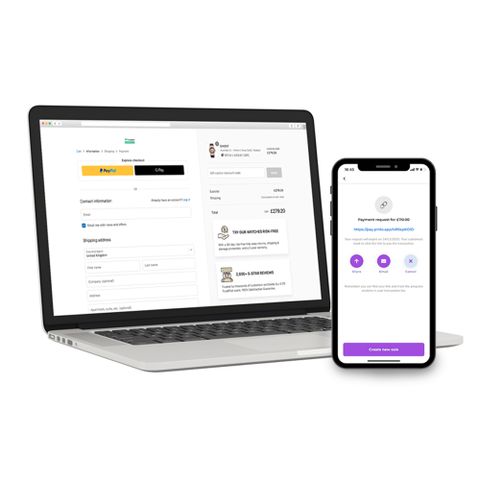

We offer a range of secure services from countertop and portable devices to secure online payment systems, giving you the flexibility to take payments where ever your business takes you.

Use our online quote tool to get a quick quote and prices for your business

A range of Smart Terminals, Mobile, Countertop & Portable Machines to suit your business needs

Whether you accept online payments through your website or send payment links to customers, we have the solution for you

We offer a range of secure services from countertop and portable devices to secure online payment systems, giving you the flexibility to take payments where ever your business takes you.

Use our online quote tool to get a quick quote for your business

A range of Smart Terminals, Mobile, Countertop & Portable Machines to suit your business needs

Whether you accept online payments through your website or send payment links to customers we have the solution for you

Let's get you connected with our range of affordable business broadband packages.

Business insurance for your needs. Rest assured, we have you covered.

Payment terminals that are right for you. Simple. Fast. Affordable.