Understanding the basics of mobile payments

Mobile payments are transforming the way businesses handle transactions! Learn how they work, why they're essential for your business, and how to get started.

Mobile payments are transforming the way businesses handle transactions! Learn how they work, why they're essential for your business, and how to get started.

Mobile payments have transformed the way businesses and customers manage transactions. They’ve made paying for goods and services faster and more convenient than ever before. But how do these payments work, and what should you know to make the most of this tech for your business? Let's break it down in simple terms, so you can confidently integrate mobile payments into your operations.

Mobile payments are transactions made using a mobile device, such as a smartphone or tablet. These payments include various methods, such as digital wallets (Apple Pay, Google Pay, Samsung Pay), peer-to-peer payments, and even mobile banking.

Digital Wallets: Apps or software that store your payment details securely on your smartphone. Examples include Apple Pay, Google Pay, and Samsung Pay, allowing you to make payments without needing your physical wallet.

Peer-to-Peer Payments: Apps like Venmo or PayPal enable users to send money to each other directly through mobile devices.

Contactless Payments: Through Near-Field Communication (NFC), you simply tap your phone on a card terminal to complete the payment.

QR Code Payments: Scan a QR code displayed at a business location to make a payment, which is becoming popular in some areas.

When you make a mobile payment, your device connects with a payment terminal using NFC or similar technologies. Here’s the process, broken down into simple steps:

1. Initiation: You start the payment by tapping your phone on the terminal or scanning a QR code.

2. Authentication: To ensure security, your phone may require biometric verification (like a fingerprint or face scan) before the transaction is completed.

3. Processing: The payment gateway processes the transaction, ensuring that all payment details are encrypted to protect your data.

4. Completion: Once approved, the payment is processed, and you receive a confirmation on your phone.

Mobile payments offer numerous advantages that can boost your business:

Speed and Convenience: Mobile payments are quick, reducing customer wait times and improving satisfaction.

Security: Mobile payments use encryption and tokenisation, ensuring your transactions are secure.

Increased Sales: Offering mobile payment options attracts more customers, especially those who prefer to pay via smartphone.

Better Cash Flow: Payments are processed faster than traditional methods, which means quicker access to funds.

When it comes to mobile payments, security is a top priority. Fortunately, mobile payment systems are designed with multiple layers of protection:

Encryption and Tokenisation: Encryption scrambles your payment information, while tokenisation replaces your card details with a unique token, making it more difficult for cybercriminals to access sensitive data.

Transaction Authentication: Mobile payment systems often require a PIN, password, or biometric verification to confirm the identity of the user before processing the payment.

Compliance with Standards: Leading mobile payment providers comply with industry standards and regulations to ensure that your data is handled securely.

Apple Pay: This popular digital wallet enables users to make payments using their Apple devices. It’s well-known for its user-friendly interface and top-notch security, including biometric authentication.

Google Pay: For Android users, Google Pay is a seamless option, allowing them to store payment details securely for quick transactions.

Samsung Pay: Samsung Pay offers the unique ability to work with both NFC and traditional magnetic stripe terminals, providing a versatile and widely accepted mobile payment option.

Getting started with mobile payments for your business is simpler than you might think. Here's a quick guide to help you:

Choose a Payment Provider: Research and select a payment provider that offers mobile payment options your customers are likely to prefer.

Integrate with Your System: Work with the provider to integrate their payment technology with your existing point-of-sale (POS) system.

Train Your Staff: Make sure your staff is trained to process mobile payments and handle common issues that may arise.

Promote the Service: Inform your customers that you offer mobile payment options through signage and online communications.

What If Something Goes Wrong? Most mobile payment providers offer quick support if issues arise. It’s crucial to have a point of contact to address problems and ensure smooth operations.

Is It Worth the Investment? Although there may be initial costs to setting up mobile payments, the benefits, including faster payments, improved security, and better customer satisfaction, usually outweigh these expenses.

Mobile payments are more than just a passing trend, they’ve become an essential part of modern commerce. By understanding how they work, how they’re secured, and how they benefit your business, you can enhance your operations and keep your customers happy. Whether you’re a small business owner or a growing startup, embracing mobile payments can give you a competitive edge in today’s fast-paced market.

We offer a range of secure services from countertop and portable devices to secure online payment systems, giving you the flexibility to take payments where ever your business takes you.

Use our online quote tool to get a quick quote and prices for your business

A range of Smart Terminals, Mobile, Countertop & Portable Machines to suit your business needs

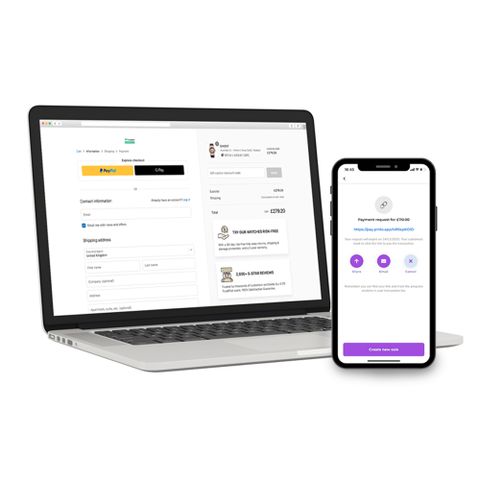

Whether you accept online payments through your website or send payment links to customers, we have the solution for you

We offer a range of secure services from countertop and portable devices to secure online payment systems, giving you the flexibility to take payments where ever your business takes you.

Use our online quote tool to get a quick quote for your business

A range of Smart Terminals, Mobile, Countertop & Portable Machines to suit your business needs

Whether you accept online payments through your website or send payment links to customers we have the solution for you

Let's get you connected with our range of affordable business broadband packages.

Business insurance for your needs. Rest assured, we have you covered.

Payment terminals that are right for you. Simple. Fast. Affordable.